Congestion in the supply chain has led to significant delays in transportation time in relation to ocean-side delays and inland congestion, boosting the need for more containers, which will lead to a glut of 13 million excess containers when backlogs are cleared.

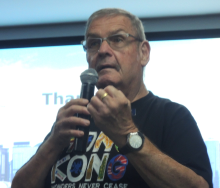

This was the warning from Alan Murphy, CEO of Sea-Intelligence, a provider of research, analysis and data services to the global supply chain industry, in his latest shipping trade analysis.

“When the supply chain gets longer, there is naturally a need for more containers, simply because each container is needed for a longer period of time. Conversely, this also means that once the supply chain normalises, there will be a release of a significant number of containers, which are no longer needed,” Murphy said.

In an attempt to quantify the number of excess containers the industry could potentially find in circulation by 2023, the firm analysed data provided by Hapag-Lloyd and matched transported cargo volume and equipment fleet over a longer period of time. Murphy noted that the research estimated for the industry came with the caveat that Hapag-Lloyd’s operational performance in relation to their equipment was taken as a proxy for the entire market.

“We started the analysis by looking at the development in both the size of the equipment fleet as well as the number of transported containers over the past 12 years. This was followed by calculating the equipment efficiency, by looking at how many full loads of cargo were moved per container in the equipment fleet,” Murphy said.

In 2010-2014, the effectiveness of the equipment fleet was relatively constant at 1.3 loads per container per quarter, followed by a lot of volatility in 2014-2017 and stabilising again at an average of 1.18 full loads per container in 2018-2019. In 2020-2022 the effectiveness declined significantly to 0.95 loads per container in 2021-Q4, slightly improving to 0.98 in 2022-Q1.

“Contemplating the normalisation of the supply chain, in 2022-Q1, Hapag-Lloyd needed an equipment fleet of just over three million TEUs to move their cargo. If the supply chain bottlenecks were removed now, Hapag-Lloyd would need 17% fewer containers in their equipment fleet, compared to what they have presently. If this is representative of the global market, there would be a need for 17% fewer containers than what we currently have,” Murphy said

The global container fleet reached 50m TEUs in 2021.

“If 17% of this becomes redundant, this equals 8.5m TEUs in excess equipment. Accommodating for the 4.5-4.8m additional TEUs to be delivered in 2022, we end up with 13m TEUs of excess containers in 2023,” Murphy said.