South Africa’s private-sector freight industry is fully prepared to oppose the Merchant Shipping Bill in its current form, Terry Gale of Exporters Western Cape (EWC) told a trade gathering in Cape Town on Wednesday night.

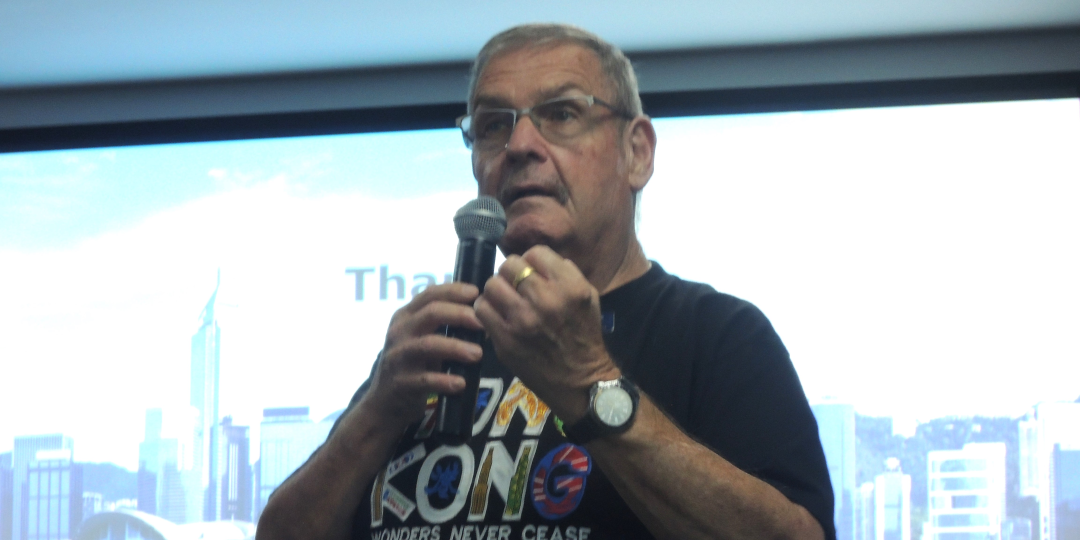

Speaking at a presentation by the Hong Kong Trade Development Council, the chairman of the EWC said: “We understand that the Bill is heading back to parliament and I want to tell you that we are going to fight it.”

Asked whether he was referring to the section in the Bill proposing cabotage, the practice of disallowing commercial container lines from calling at more than one port on a country’s coast, Gale said yes.

He explained what the Bill was proposing. “They want to establish hub ports. In other words, a shipping line coming from Europe, for example, will have one port call in South Africa.”

He said that a box ship berthing in Durban with containers destined for Cape Town would have to offload those containers for trans-shipment to the final port of destination.

As the Bill stands, it is understood that the intention is for the state to launch an SA-flagged fleet that will handle the coastal redistribution of containers.

According to more than one private-sector source Freight News has approached, the idea is to launch a state-owned entity (SOE) that will be responsible for trans-shipment along the country’s coast.

“It’s a ludicrous idea,” an ocean freight stakeholder said.

“It’s primarily used in countries like the US where the entire logistics chain is far more advanced than South Africa’s. Currently, it’s simply not feasible at all. If our government didn’t have the reputation it has when it comes to running SOEs, state-owned transhipment along our coast might have been worth considering. It’s obviously meant to generate more revenue for our fiscus. But you only have to look at what happened to Eskom and Transnet to realise that the Bill, as it pertains to cabotage, is a bad idea.”

Gale said: “Think of what happened to Safmarine,” the SA-owned shipping line that was eventually taken over by Maersk in 1999 and entirely absorbed into the Danish line’s brand.

“The government had an opportunity with one of the most incredible shipping lines in the world, but they lost that opportunity.”

He said a government-enforced transhipment system in South Africa would add significant cost to the entire supply chain by adding complexity at hub ports, as it would require multimodal logistics for the redistribution of containers.

He pointed out that one only had to look at what was currently happening at the country’s ports to realise that cabotage on SA’s coast wouldn’t work.