Agribusiness leaders have sounded the alarm over repeated government undertakings of growth-friendly reforms that are not implemented, and expressed grave concerns over VAT increases in the face of persistent food insecurity.

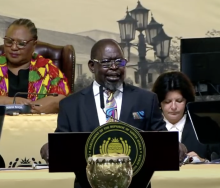

In reaction to Enoch Godongwana’s belated budget vote, Sean Walsh, chairman of the agricultural business chamber, Agbiz, said spending without economic reforms, spending prudence, and reduced wastage “won’t be sufficient to set us onto a long-term path of economic growth”.

“We need to seriously implement the economic reforms referred to in the past budget speeches and normalise government spending on welfare programmes.”

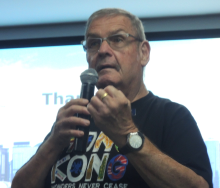

To this, Agbiz CEO Theo Boshoff added: “The infrastructure investments referred to (in Godongwana’s budget) will be positive for agriculture, but these have been alluded to for a long time. What we need now are clear timeframes and implementation.”

Boshoff noted that the recommendations from Operation Vulindlela should be priority number-one.

“We have seen the positive impacts brought about by reforms in the energy space, but we urgently need reform in the logistics, water, and ICT space to create an enabling environment for businesses. The agribusiness sector is affected by all of these policy areas, and while we are aware of positive changes taking place in the logistics sector, many businesses still face extremely high costs of doing business due to basic service delivery challenges.”

He added that a reformed financial model for local government should be prioritised.

“We have heard repeated reference to the White Paper on Local Government, but little is known about what reforms it will propose. In the meantime, the equitable share allotted to local government has increased, so we hope that stricter controls and accountability will follow.”

Walsh said: “Finding the right balance between government spending that can boost economic growth, and taxing the public to do so is no easy task and intuitively counter-productive.”

In the light of the Food Security Report released last month by Statistics SA, showing severe food insecurity in the face of a secure supply of affordable food, Walsh said Agbiz was very concerned about what the incremental increase in Value Added Tax would do to food security.

“That being said, a phased-in, one percentage point increase over two years is much more palatable than the previous rumours of a two percentage point increase.”

Boshoff said the organisation was grateful that the list of zero-rated VAT products would be extended to lower-value portions for all animal proteins.

“Previous proposals focused on a single animal product, which could have distorted the market and created unfair competition. The proposed solution is certainly more equitable towards all animal-based commodities.”