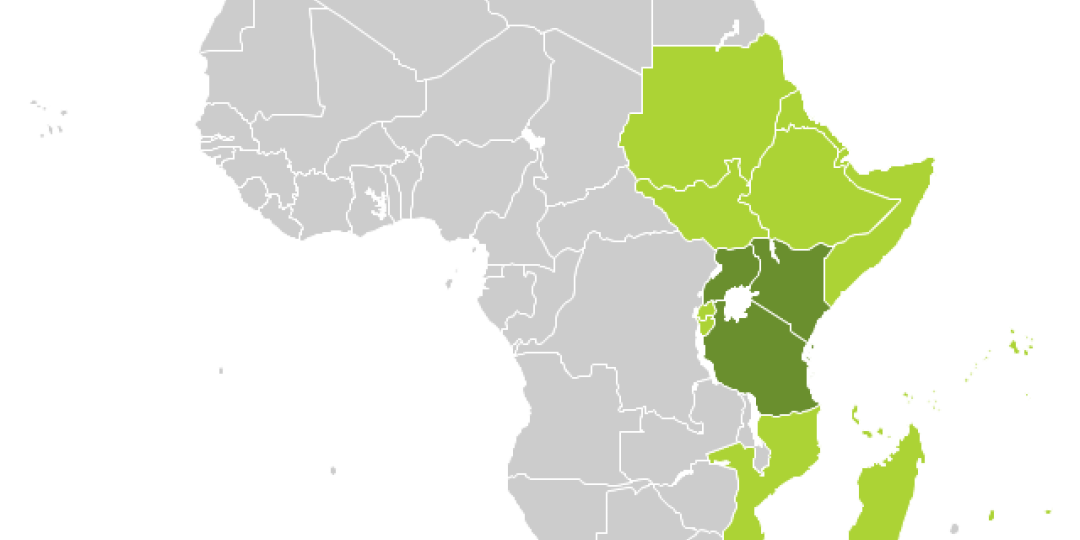

Grindrod identified planned expansion in East Africa and Northern Mozambique when it released its provisional reviewed results for the year ended December 2020 yesterday. “This would unlock the Zambian and Dar es Salaam corridor, and facilitate logistics solutions in Lake Victoria,” said Andrew Waller, CEO Grindrod Limited.

“Our business is about operating supply chains, leveraging our strategically located terminals, port operations, rail, and logistics assets – and our divisions work together and collaborate with customers to ensure we provide bespoke solutions and deliver on our purpose.”

The company reported solid results in its core operations, with the port, terminals, and logistics businesses recovering well in the second half of the financial year, according to Waller.

Its core revenue was R4.7 billion, trading profit R1.4 billion, and core earnings R329 million.

Overall, Ports & Terminals matched 2019 earnings. Maputo Port achieved earnings growth of 18% on 2019 on volumes of 18.4 million tonnes. “Cargo transported to the port by rail versus road has improved through the increased allocation of Transnet train sets,” he said. “Matola Terminal delivered improved tariffs and cost management, which mitigated the decline in volume. The terminal handled 5.5 million tonnes with 10% higher volumes in the second half of the financial year. Magnetite and chrome markets have improved with strong pricing.”

The coastal shipping and landside container business had benefited from increased shipping activities, a buoyant citrus season, and strong mineral volumes, he said. The business reported earnings growth of 15% on 2019.

The company’s container business has increased its footprint and diversified into bulk cargo - for example, by partnering with key customers, Grindrod facilitates the export of minerals through the Maydon Wharf Terminal in Durban.

“The clearing and forwarding business delivered healthy earnings growth of 83% due to extensive work on both existing and new contracts. Ships Agency achieved positive earnings for the period from a loss position in 2019.”

Overall, the northern Mozambique operations reported 13% earnings growth for the period. “Grindrod’s intermodal facility in Nacala is a good example of developing a fit-for-purpose infrastructure for customers. Initially, the facility, together with a fleet of trucks, provided a logistics solution for transporting graphite from a mine in Balama to global markets. While the mine is in care and maintenance until graphite markets improve, the Nacala facility has provided the perfect base to operate on the Malawi corridor, where volumes have increased.”

He believes Grindrod’s strategic presence in Northern Mozambique has provided the ideal springboard to be one of the early logistics providers for the LNG project in the Cabo Delgado region.