As significant excess capacity enters the shipping market – with the same predicted for next year – the big question facing analysts is when the overcapacity market will balance again.

The most positive scenario, says CEO of maritime consultancy Sea-Intelligence, is container volume growth of 3.8% year-on-year from 2024, matching the average growth of the post-financial crisis and pre-pandemic period of 2011-2019.

This needs to be accompanied by supply growth in 2023-2026 based on the current orderbook, and supply growth of just 1.3% for the period post-2026, matching the lowest level seen in the past 10 years (in 2016). It also needs to be accompanied by a “structural factor” – ie, how much faster supply can grow over demand, with the market remaining in balance – of 2.2 percentage points.

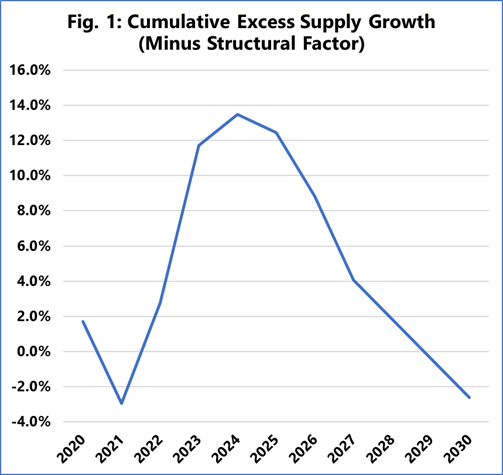

Figure 1 shows the extent of the global over-supply, compared to the pre-pandemic norm of 2019, for the 2020-2030 period, given the rather optimistic assumptions above. “So unless there is an explosion in global container demand, another pandemic soaking up capacity, or carriers laying up a significant share of the global fleet and ordering no more vessels, then we could see a 2019 level of supply/demand balance in 2028,” says Murphy.

“Gaining this balance in 2028 would imply an eight-year span – the same as the cycle from the financial crisis until balance was restored in 2017. The worst of the overcapacity will be seen in 2024, and by 2026, a third of the overcapacity will have been absorbed.”

However, Murphy warns that if the assumptions underpinning the positive scenario are put in jeopardy by lower demand growth, even modest supply growth, or a lower structural factor, all of which are quite likely, then the 2019-level balance could be pushed out to 2030 or beyond.