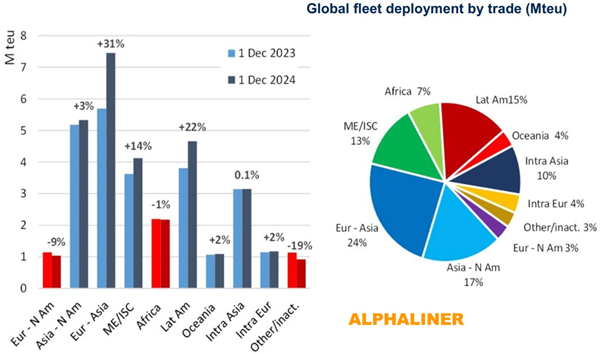

The global container fleet has increased significantly over the past 12 months, with almost three million TEU slots added to the fleet, according to the latest data released by Alphaliner.

“No less than 1.76 Mteus, or 59% of this extra capacity, was absorbed by the Asia - Europe trade, where many additional ships were needed as services were rerouted via the Cape of Good Hope to avoid dangerous passage through the Red Sea,” Alphaliner said in a statement.

When it last analysed the trade in June, capacity had already grown year-on-year by 24%. Six months later, fleet growth stands at 31% and some carriers are still awaiting the delivery of more newbuildings to fill the final gaps in their Asia-Europe schedules.

“Demonstrating the impact of the additional TEU-miles around the Cape, however, weekly capacity offered on the route has risen by a much smaller percentage. On December 1, 2023, a weekly average of 434 940 slots was offered on the Asia-Europe trade. A year later, on December 1, 2024, this had risen by only 38 360 TEUs, or 8.8%, as rerouting gobbled up capacity,” the data collection agency said.

While many analysts warned of potential overcapacity in 2024, the Cape diversions absorbed so much capacity that the industry terminated the year with almost no idle tonnage. Just 0.6% of the total container ship fleet was deemed commercially inactive.

“The year 2024 will be remembered in liner shipping circles as the first year of the Red Sea crisis, just as 2021 and 2022 are now commonly referred to as the lucrative Covid-19 years,” Alphaliner noted.