Major United States container ports are expected to have another busy month in September ahead of a potential labour strike at the country’s East Coast and Gulf Coast ports.

This is according to the National Retail Federation and Hackett Associates’ Global Port Tracker report released on Monday.

“This is a critical time as retailers prepare for the all-important holiday season, and we need every port in the country working at full capacity,” said NRF Vice President for Supply Chain and Customs Policy, Jonathan Gold.

“Many retailers have brought cargo in early and shifted to alternate ports as a precaution, but it is vital that labour and management at the East Coast and Gulf Coast ports actually sit down at the negotiating table and bargain in good faith for a new contract so we can avoid a disruption of any kind when their contract expires,” he said.

“A strike would be another blow to the supply chain as it continues to face challenges, and to the nation’s economy at a time when inflation is finally coming down and the Fed (Federal Reserve) is poised to lower interest rates.”

The contract between the International Longshoremen’s Association (ILA) and the United States Maritime Alliance covering East and Gulf Coast ports is set to expire on September 30. The ILA has threatened to strike if a new contract is not reached by then.

The NRF last week renewed its call for both sides to come to an agreement before the contract expires, as the disruption of a strike would significantly impact retailers, consumers and the economy.

Hackett Associates Founder Ben Hackett said import levels were being impacted by concerns about the potential port strike.

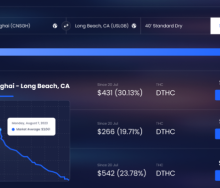

“This has caused some cargo owners to bring forward shipments, bumping up June-through-September imports. In addition, some importers are weighing the decision to bring forward some goods, particularly from China, that could be impacted by rising tariffs following the election,” said Hackett.

According to the latest Global Port Tracker, US ports covered by the report handled 2.32 million TEUs in July, the latest month for which final numbers are available. This represents an increase of 8.1% from June and a 21% annual increase, marking the highest July throughput on record.

Ports have not yet reported August’s numbers, but Global Port Tracker projected the month at 2.37 million TEUs, up 20.9% annually and the highest level since the record of 2.4 million TEUs set in May 2022.

September is forecast at 2.31 million TEUs, up 14% annually, while October has been forecast at 2.08 million TEUs, up 1.3% annually.

If the forecasts prove correct, 2024 will have seen a seven-month stretch of import levels at or above 2 million TEUs. However, the volume for January 2025 is forecast at 1.96 million TEUs, down 0.3% annually.

The import numbers come as NRF is forecasting that 2024 retail sales, excluding automobile dealers, fuel stations and restaurants, will grow between 2.5% and 3.5% during the rest of 2024.