The SA Reserve Bank’s latest 25 basis point interest-rate hike is not expected to halt the recovery that the country’s commercial property market is currently experiencing.

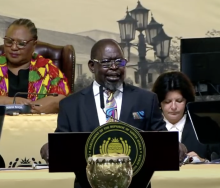

The was the of view of FNB Commercial Property Finance property sector strategist, John Loos, after the bank announced its latest interest-rate increase on Thursday.

“The view from a commercial property finance perspective is that the 25 basis point interest-rate hike will not yet halt the strengthening trend that we have seen in commercial property market sales activity, as reported in our FNB Property Broker Surveys,” said Loos.

“The commercial property market is more sensitive to economic growth trends than the housing market, and less sensitive to interest-rate movements than the housing market, and, as such, probably still has some improvement to come in the near term, on the lagged impact of economic recovery coming out of 2020 hard lockdown.”

Loos said he anticipated a series of further 25 basis point interest-rate hikes at each MPC meeting during the remainder of 2022.

“We would expect that some slowing in the commercial market could be witnessed somewhere in the latter half of this year. Gradual interest-rate hiking could provide some mild positive support for the residential rental market,” he said.

However, he said residential rental market vacancies had started to turn lower (improve) late in 2021, and rental inflation had started to accelerate.

“The gradual rate hiking could cause this mild recovery to continue in 2022 as a portion of aspirant home buyers postpone their home purchase while interest rates rise, remaining in the rental market and providing support to it for longer. The residential development market typically lags the existing home buying market and, as such, we still see relatively solid building activity in this market in the near term, despite the latest rate hike.”

Loos added that further expected increases in the interest rate were only expected to lead to a decline in new building plans passed much later in the year.