The spectacular profits posted by shipping lines during the Covid period have been replaced by news of the spectacular losses amid a normalising demand pattern.

According to research by maritime consultancy Sea-Maritime, in Q4 of 2023 carriers recorded a combined Ebit loss of -$1.44 billion. Maersk (-$920 million), Hapag-Lloyd (-$252m), ONE (-$248m), Yang Ming (-$109M), ZIM (-$54m), and Wan Hai (-$41). Comparing these figures across the same set of shipping lines (minus ONE due to lack of historical reference points, and including Evergreen and HMM, both of whom had operating profits in 2023 Q4), this was the highest combined Q4 Ebit loss in 2012-2023, with the previous highest of -$455m recorded in 2015 Q4.

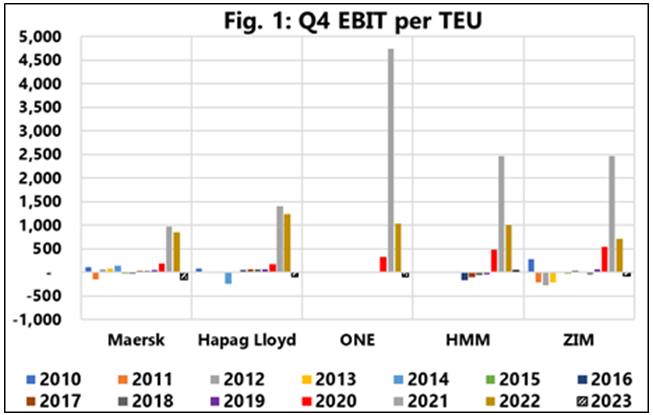

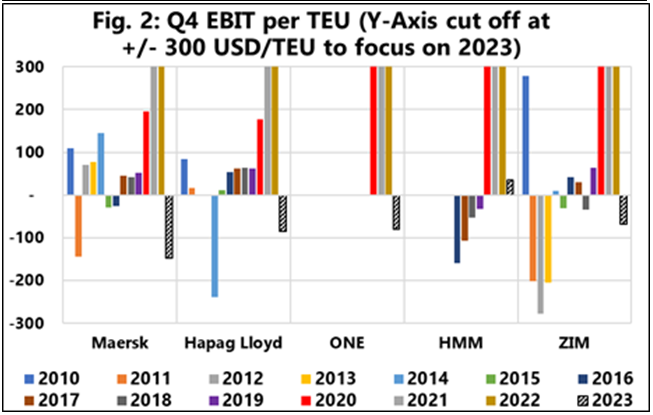

To see profitability (or the lack thereof) per TEU shipped, Figure 1 shows the Ebit/TEU for 2010-2023 and shows the unprecedented levels of the 2021-2022 pandemic period, whereas Figure 2 cuts off the y-axis at +/- $300/TEU to show the developments in 2023.

“So far, we have Ebit/TEU data for five shipping lines, with COSCO missing from those that regularly report on both their Ebit and global volumes,” says CEO Aan Murphy. “Maersk’s Ebit/TEU of -$148/TEU is their largest negative Ebit/TEU in the analysed period. For Hapag-Lloyd, their Ebit/TEU loss of -$84/TEU is smaller than their only other negative Ebit/TEU of -$239/TEU in 2014 Q4. For ONE, their negative 2023 Q4 Ebit/TEU of -$80/TEU is their first. HMM, on the other hand, recorded a positive Ebit/TEU of $34/TEU in 2023-Q4.”