Seaborne traffic across all shipping segments sailing around South Africa has risen by a remarkable 53% in the past three months as the world witnesses a sea change to the global liner trade map.

This finding was based on exclusive data compiled by the ocean freight trade analytics platform Sea Live, comparing maritime traffic in the second week of October last year to the second week of January.

In stark contrast to this increase, there has been a significant drop in maritime traffic between the Suez Canal and the Gulf of Aden because of Houthi rebels attacking maritime vessels in the Red Sea.

The attacks, which started last year when Yemeni rebels seized the Galaxy Leader, a roll-on roll-off vessel carrying 4 500 vehicles headed to India from Turkey, are carried out by Ansar Allah militia members opposing Israel's war on Gaza.

The latest maritime casualty was the US-listed Marshall Islands-flagged Genco Picardy bulk carrier belonging to Genco Shipping & Trading, which was hit by the Houthis in the Gulf of Aden.

The vessel sustained minor damage.

The full scale of shipping’s Red Sea exodus, whereby vessels are diverted around the Cape of Good Hope for safety reasons, is glaring.

This was especially apparent this week when no LNG carrier was present in the Red Sea for the first time this century.

Some of the largest players in the industry has confirmed this changing pattern in sea trade, including Japan’s Nippon Yusen Kaisha (NYK), Mitsui OSK Lines (MOL) and Kawasaki Kisen Kaisha (K Line).

All three have suspended navigation through the Red Sea.

AXS ship tracking data reveals a tangible reduction in tanker transit patterns through the hot zone in December 2023, when an average of 26 oil and chemical tankers above 25 000 dwt per day transited the Bab el-Mandab Strait at the southern tip of the Red Sea.

However, in the first half of January 2024, this figure dropped by 38% to an average of 16 tankers, according to new analysis from brokers Braemar.

Ominously, at this week’s World Economic Forum in Davos, Switzerland, Maersk CEO Vincent Clerc cautioned that the disruptions will continue for some time.

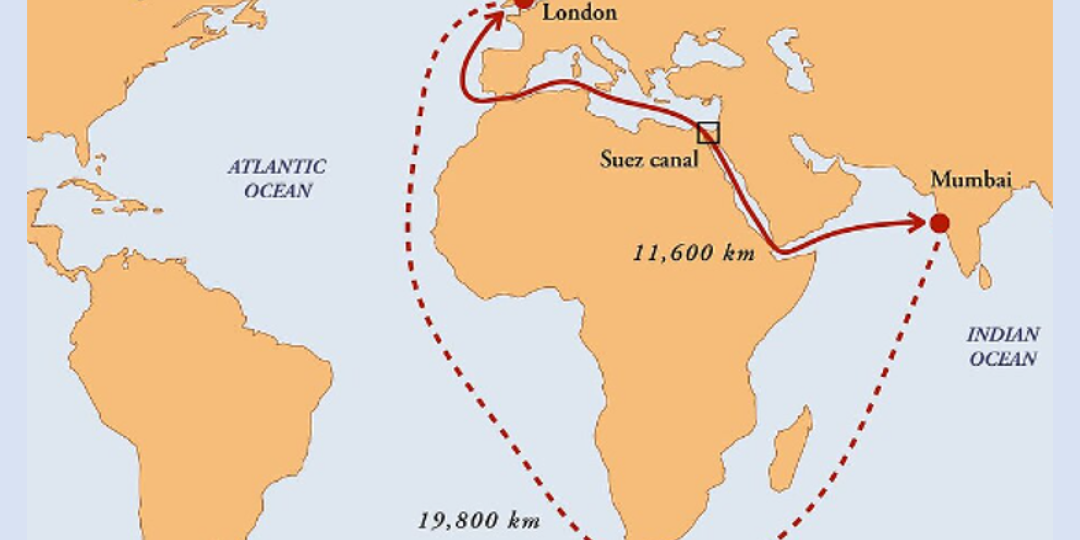

Not using the Suez Canal means a vessel from the UK’s Port of Felixstowe, heading towards Mumbai in India, has to complete a journey of 19 800 kilometres compared to 11 600km via the Mediterranean-Suez-Arabian Sea route.

On average, such a voyage could take more than 33 days at sea, whereas a Suez sailing could take about 17 days or less.

SOURCE: Asia Shipping Media