Global demand for container shipping is expected to grow by 3% according to the latest forecast by Xeneta.

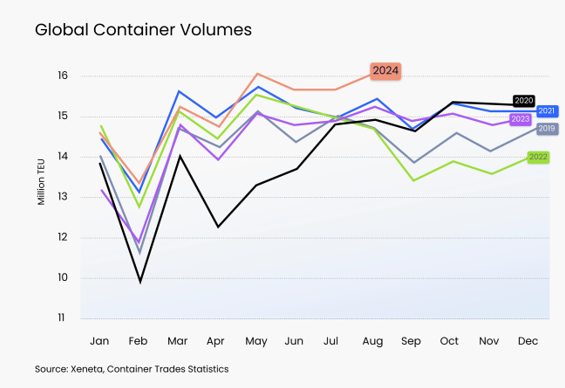

According to the ocean and airfreight analytics platform, global demand for shipping in the first eight months of 2024 was up 6.7% year-on-year, with May and August both surpassing the 16m TEU mark, which has never happened before.

Xeneta expects total demand growth for 2024 to land at 4-5% and break through 180m TEU, surpassing the all-time high of 179.8m TEU in 2021. It forecasts growth will slow to around 3% in 2025.

“2024 has been a year characterised by shippers’ extensive frontloading of cargo to safeguard supply chains and ensure enough goods were on inventory should even worse disruptions be on the way,” Xeneta said in its 2025 Ocean Outlook report.

China to Mexico trade has been in the spotlight in 2024 with TEU demand growth increasing 22.1% compared with 2023. This follows full year-on-year growth of 34.6% in 2023.

“One of the key reasons is found in the cooling relations between China and US, and Mexico being seen as a back door to avoid import tariffs. Looking ahead to 2025, demand is expected to increase further on this trade,” said Xeneta.

“Another one to watch is China to the Middle East, where volumes are 52% up from 2021.”

In the euro area, GDP growth is set to climb to 1.5% in 2025 from the low base of 0.9%, while it is sliding downwards in the US to 1.9% from an expected level of 2.6% in 2024.

“Overall inflation has come down from the peaks of 2022/2023 and, more importantly, it is now mostly on services rather than goods. Overall inflation looks like it will stay above the 2.0% threshold targeted by the European Central Bank and Federal Reserve, so consumers may still struggle to go on buying sprees,” Xeneta said.

Wage growth in 2025 is expected at 3.4% for the euro area and 2.5% in the US, down from 4.3% and 3.2% respectively in 2024.

According to the report, factors that could increase demand in 2025 include a faster decline in US inflation, the recovering German economy and disruption such as natural disasters and geopolitical events.

Factors that could adversely impact demand include retailers normalising inventories after 2024 frontloading of cargo, geopolitical deterioration and the imposing of new sanctions, consumers being fearful of the future, including rising unemployment in the US, and interest rates not being cut fast enough in the US and Europe.

Xeneta chief analyst Peter Sand said macro-economic developments set the overall direction for container shipping demand but shippers also needed to understand market nuances at a regional and port-to-port level.

“2024 was very much driven by frontloading of cargoes in addition to longer sailing distances. Any change in this approach…represents a downward risk to demand unless 2025 turns out to be even more dramatic.”