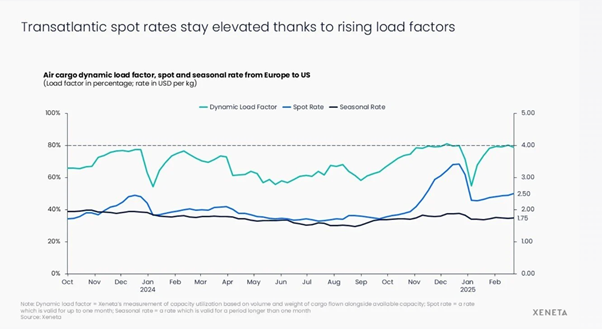

Europe to US air cargo spot rates have picked up 7% month-on-month in February so far to reach $2.46 per kilogram in contrast to other corridors that have seen double-digit declines.

This is according to the latest data released by ocean and airfreight market think tank Xeneta on Wednesday.

According to Xeneta the Northeast Asia to US market has seen a rate decline of 14%, while transatlantic spot rates showed 23% growth year-on-year, compared to 9% growth from Northeast Asia to the US.

“The month-on-month growth in spot rates on the transatlantic westbound corridor was partly driven by a post-holiday recovery in demand. In contrast, the double-digit year-on-year increase in spot rates was not fuelled by a surge in demand or any inventory build-up in anticipation of US tariff hikes, but rather due to a capacity pull phenomenon,” Xeneta noted.

One of the primary factors behind this phenomenon is the traditional reduction of belly capacity by carriers during winter. The belly capacity reaches a trough in February before gradually rising again in March.

The other primary factor is perhaps less traditional, namely the shift of dedicated freighter capacity from the Transatlantic corridor onto the more lucrative Asian market as carriers look to capitalise on the e-commerce boom.

“The transatlantic capacity pull phenomenon means the dynamic load factor on this corridor (the measurement of capacity utilisation based on volume and weight of cargo flown alongside available capacity) hovers around 80% in February, a similar level to the year-end peak season, which often indicates increased negotiating powers from freight sellers,” Xeneta said.

The result is a spot rate environment that maintains a gap of more than 70 cents above seasonal rates.

“The freighter capacity shift away from the transatlantic market to Asia demonstrates the importance of shippers being aware of the risks posed by an increasingly complex global trade landscape,” Xeneta added.

The Trump administration’s tariff agenda, with its planned ad hoc ‘reciprocal’ tariff on imports, adds another layer of uncertainty.

“If tariffs are imposed with short notice, shippers will struggle to rush exports, limiting their ability to mitigate cost impacts. This could further dampen transatlantic freight demand,” Xeneta said.

Locking in contracts without built-in contingency plans or flexible terms can lead to missed opportunities for securing lower airfreight rates.

The sheer volume of goods being exported out of Asia means any escalation in the US-China trade war could indirectly impact the transatlantic market.

For example, the colossal increases in cross-border e-commerce volumes out of China have been a driver for global air cargo demand in 2024. However, a combination of post-year-end retail peak season decline, Lunar New Year factory closures and Trump’s proposals to remove de minimis exemptions is slowing transpacific air cargo demand.

“The picture is further complicated by another geopolitical situation in the Middle East. A lasting ceasefire between Israel and Hamas could see a large-scale return of container ships to the Red Sea,” Xeneta said.

This would result in some cargo currently being moved by airfreight to avoid the disruption of shipping switching to ocean freight once again.

Xeneta advised shippers to adopt a “cautious yet flexible approach” to navigate the volatile environment.

“Due to trade policy uncertainty, shippers should stay vigilant and closely monitor further changes in US tariff policies - not only those affecting Europe but also measures directed at other markets, such as China, which could alter the competitive landscape at a global level,” Xeneta said.

The combination of factors including the removal of de minimis exemptions, the potential return of Red Sea container shipping, and airlines’ seasonal capacity adjustments means shippers could benefit from postponing negotiations for new contracts until the second quarter. This could secure more competitive rates if the geopolitical situation and markets turn in their favour.

“Use real-time benchmarking data to renegotiate terms and protect margins. Consider shifting from fixed-rate to index-linked contracts to better handle market volatility,” Xeneta advised.

“Explore additional sourcing routes and diversify export origins to reduce overreliance on a single market. Every market across both air and ocean modes is impacted by the current geopolitical climate, so you are not alone if you are suffering from the uncertainty and volatility on the transatlantic corridor.”

However, it is something shippers must get used to because the uncertainty is set to last, Xeneta added.

“If you use airfreight to transport your goods and want to retain competitive advantage, you must vigilantly monitor these policy changes.”