Latest analysis of the demand/supply ratio in the container shipping industry points to a continued decline in demand, whichever metric is used.

And this leads to the simple conclusion - that there is no underlying structural support for the high rates on the Transpacific and Asia-Europe trade, says Sea-Intelligence.

The maritime consultancy points out that global demand is continuing to decline, and whether it’s calculated in TEUs or as an annualised percentage over 2019, it’s clear that the supply/demand balance is under a lot of pressure.

“The latest demand data from Container Trade Statistics, a provider of data about the global container shipping industry, shows that in August the annualised growth over 2019 was below the level seen in 2019, which means that unless carriers reduce capacity substantially, vessel utilisation will be low.

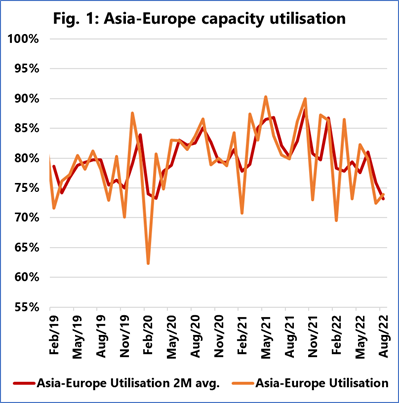

“For shipping lines to maintain the ultra-high spot rate levels, a nominal utilisation in excess of 92%-93% needs to be sustained on the Transpacific,” says Sea-Intelligence CEO Alan Murphy, “with the threshold on Asia-Europe being 85%.”

On the Transpacific, utilisation dropped below 90% for much of 2022, becoming a catalyst for the continued freight rate drop. In August, utilisation crossed the 90% mark, but only just, still falling short of the 92% threshold to indicate a rate increase, he adds.

“On Asia-Europe, utilisation has been dropping even further. As we can see in figure 1, 2022 utilisation on Asia-Europe has been consistently below the 85% threshold to trigger a rate increase, and although the utilisation improved in August to 74% from 72% in July, the rolling two-month average saw a further decline from 76% to 73%.”

This latest data is a clear indication that there is no structural support for the high rates on the Transpacific and Asia-Europe trade.