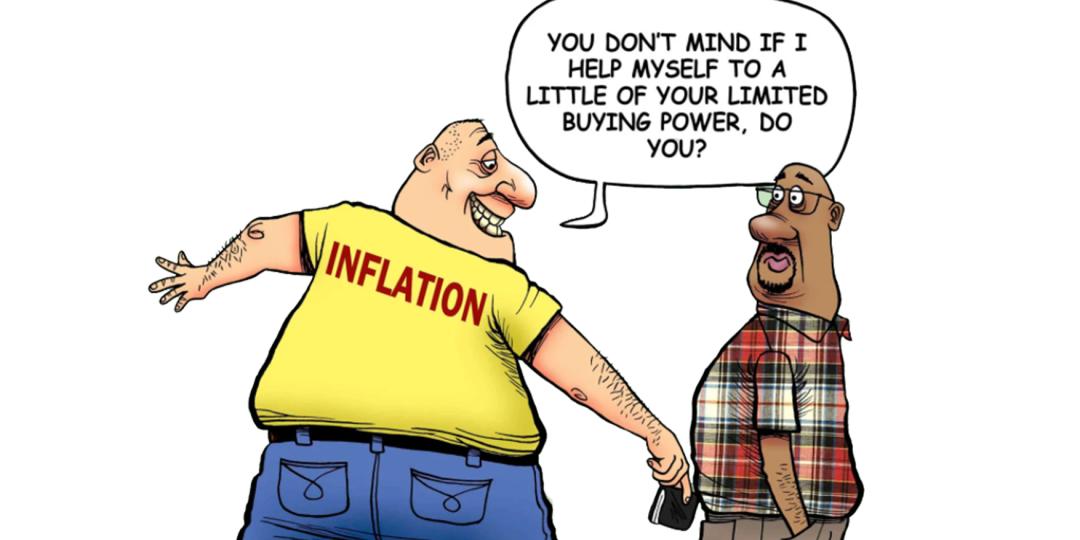

Inflation has been identified as the key concern of leading financial institutions who participated in a crystal-ball-gazing exercise by Wall Street, with fears of the potential impact of inflationary effects receiving 224 mentions in predictions for the year ahead.

Interestingly, the mild effect of the latest variant of the coronavirus, despite the virulent infection of the 4th wave, seems to have manifested in a widely agreed sentiment that Covid-19 could be down although not out.

Of all the views received, the virus received only 36 mentions from the 50 participants approached for the Bloomberg survey.

The Bank of New York Mellon Corporation, better known as BNY Mellon, said vaccines could mean the world was “turning the corner from pandemic to endemic”.

Perhaps Omicron will soon become “omicrorner”, as most of the other views also reflect a belief that the pandemic has turned a corner, with Covid appearing to be losing its potency as it begins to show signs of fizzling out.

Furthermore, the overriding sentiment is that there should be growth into the new year, although lacking the explosive momentum seen last year when markets increasingly started opening up from the devastation of lockdowns.

Multinational firm Goldman Sachs said it believed in the investment potential of China, as did several other institutions banking on the growth potential of emerging markets.

Unfortunately, the eroding effect of inflation, coupled with ongoing concern, continued to weigh heavily on financiers, the survey found.

French group AXA Investment Managers said rising inflation was the spectre that cast a shadow over consumer momentum.

However, Boston-based investors Fidelity argued that inflation could ease along with supply-chain pressures, provided that policy formation was on song with the growing chorus for accelerated recovery from the pandemic.