Ocean rates for contract cargo have decreased sharply month-on-month for December and January, falling 1.6% at the end of last year before dipping even further – 3.6% – at the beginning of Q1.

The first quarter rates for 2022 of mainly Asian exports shipped into Europe, as recorded by Norwegian rates platform Xeneta, fell even more, by 7.6%.

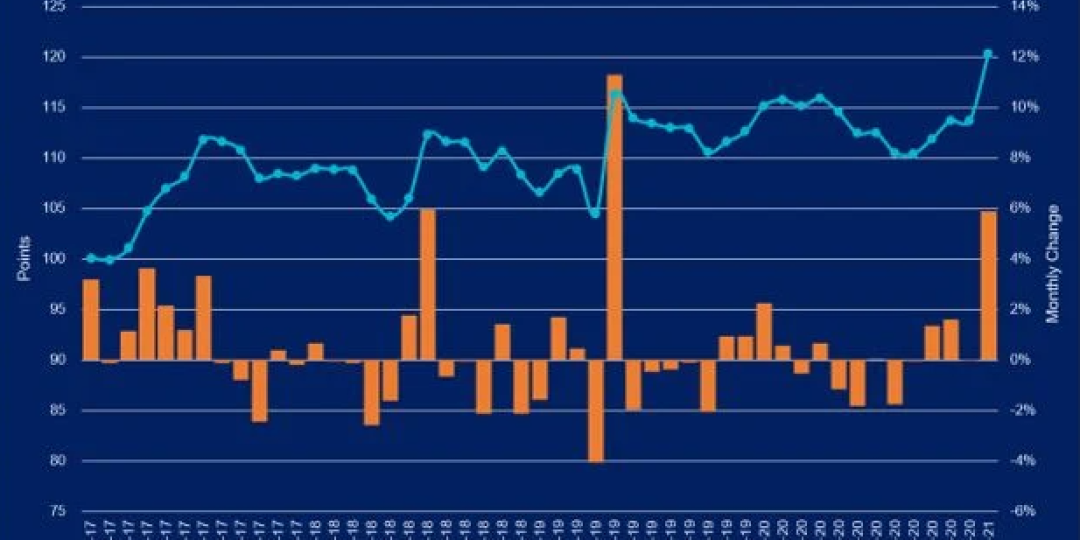

The analytics consultancy’s figures come on the back of consistent ocean rate increases, lasting for more than a year and recording yields for the liner industry that have shot out the lights.

Whereas it was initially reported that 2021 had heralded profits of around $50 billion for carriers, it is now reported that the profitably of lines last year has been vastly underestimated, and that the figure is closer to $200 billion in earnings.

Needless to say, decreasing rates must come as welcome news for shippers and agents who are hard-pressed for allocations, however costly, and when available, in a constrained market where spiking demand and lagging supply has pushed rates through the roof.

But Xeneta’s latest shipping index data for long-term work should be seen against the backdrop of lines vying for contract cargo, in which instance big-ticket clients are lured with lower rates.

It has also been said that lines are disingenuous about the lower rates they’re offering Beneficial Cargo Owners – BCO clients that could face stiff rate hikes once they’re locked into contracts.

London shipbroker Mike Wackett even reports that an NVOCC agent told him of a line that had bypassed the neutral consolidator, going directly to a certain client with lower rates.

This is after the same client was quoted much higher rates by the NVOCC, working off rates it had received from the line.

Xeneta founder and CEO, Patrik Berglund, put it more succinctly when he told Wackett that demand continued to exceed supply, playing into the hands of lines knowing full well that Covid challenges and portside throughput constraints across the globe are weighing heavily on shippers and agents desperate for backlog solutions.

“This puts the carriers in a position where they can dictate terms to shippers through elevated rates and limited availability, while locking in ‘bigger fish’ at favourable prices,” Berglund said.

SOURCE: The Loadstar