Competitive pressure among the top 10 global carriers is on the rise, according to statistics released by maritime consultancy Sea-Intelligence.

The survey looks at the size, market share, relative market share, and the Herfindahl-Hirschman Index (HHI) which measures the degree of market consolidation on a scale of 0 (perfect competition) to 10 000 (monopoly), CEO Alan Murphy explains.

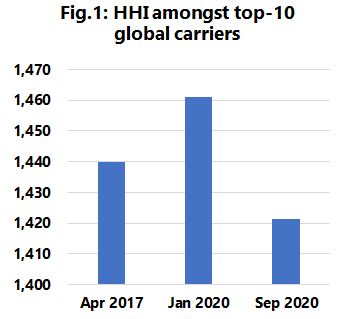

“We compared three points in time – April 2017 which is when the “new” carrier alliance structure was formed; January 2020 which is right before the Coronavirus pandemic; and September 2020, which captures the present scenario.

He says that from a global perspective the data shows that the relative competitive environment between these carriers has strengthened. “This does not mean the global market overall has seen de-consolidation – it is very evident that the opposite has been the case for the past 20 years. However, what the data shows is that within the “elite” group of the remaining 10 large global carriers, the relative landscape has flattened slightly – and therefore the competitive pressure has increased.”

In an environment where freight rates are clearly strengthening at an unprecedented pace, he says this conclusion may appear counter-intuitive. “However the data is quite clear.

“The strengthened freight rate environment since January 2020 cannot be purely ascribed to a narrowing of the competitive pressure, because in terms of market share, we have de-facto seen the opposite. However, this does lend further strength to another analytical argument, namely that the reduction in the number of competitors, the increase in the number of weekly services controlled by any alliance/VSA, and the increased transparency in pricing, has led to an environment which reduces the risk for destructive price wars and rewards carriers for actively, and rapidly, managing demand fluctuations by performing identically rapid capacity management.”

0 equals perfect competition, 1000 equals monopoly.