Xeneta has analysed the dynamics of new long- and short-term sea freight contracts and found that both carriers and shippers are hedging their bets on rate movements in 2025.

The ocean and airfreight analytics platform said it had analysed new long-term contracts set to take effect in 2025.

Amid ongoing uncertainty in the Red Sea, "the data reveals a fascinating dynamic in negotiations between sellers and buyers of ocean freight," Xeneta said.

The recent ceasefire in the Middle East has raised hopes of an industry-wide return of container ships to the Red Sea. However, analysts caution that this is unlikely in 2025.

Tensions persist in Israel despite the ceasefire, and concerns remain that the ongoing Houthi insurgency in Yemen could lead to renewed attacks on ships in the region.

Xeneta noted that if shipping lines resumed the shorter Suez Canal route, freight rates could collapse from their current high levels—a decline that would be further exacerbated by the influx of new vessels boosting capacity.

"On the other hand, the majority of container ships are still sailing around the Cape of Good Hope, with no guarantee the situation will change in 2025," Xeneta said.

With average spot rates still up 142% from the Far East to the US East Coast, 100% to North Europe, and 135% to the Mediterranean, both carriers and shippers face a dilemma when negotiating the ‘right’ price for long-term contracts, the platform added.

When comparing long-term contracts that took effect on 1 January this year to those from the start of 2024, Xeneta found that rates were rising on seven of the nine global front-haul trades tracked in its top 13 trade lanes.

Long-term contract rates for shipments from the Far East to North Europe rose 57% year-on-year, while rates to the US East and West Coasts increased by 44% and 64% respectively. Despite these rises, the new long-term rates remain significantly below current average spot rates.

Xeneta noted that carriers risked a freight rate collapse if vessels returned to the Red Sea in large numbers. As a result, they were pushing to lock shippers into long-term rates for as long as possible. Shippers, however, were wary of overpaying if rates dropped after committing to a long-term contract.

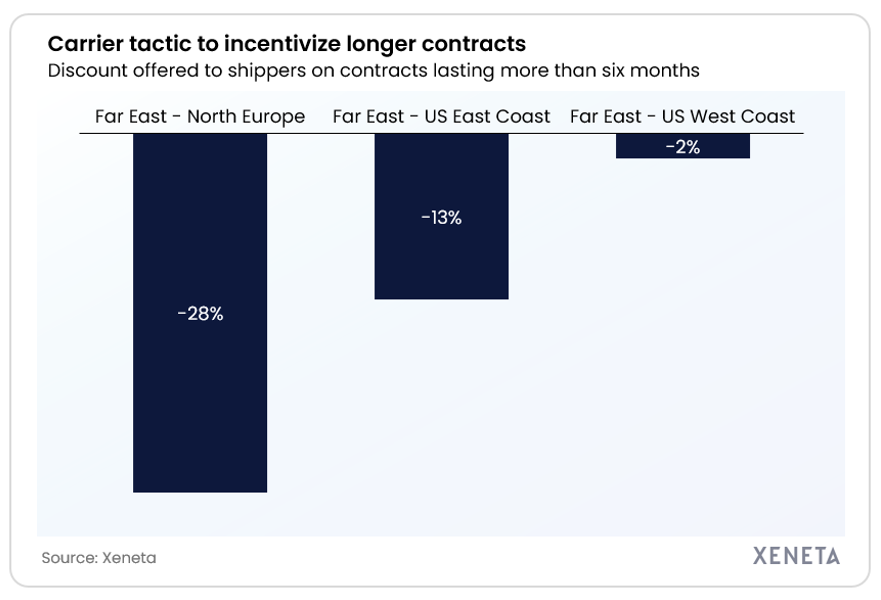

"There is a clear difference in rates offered for long-term contracts of less than six months compared to those lasting more than six months," Xeneta said.

From the Far East to North Europe, carriers were offering 22% discounts for contracts exceeding six months, while discounts of 10% and 11% were available for the US East and West Coasts, respectively.

"This creates a fascinating negotiating dynamic. Sellers seek to incentivise longer agreements to manage risk and secure market share, while buyers aim to keep their options open and avoid overpaying," Xeneta said.

"Some shippers may prefer to lock in for more than six months to protect supply chains and avoid future renegotiations amid potential global disruptions. Others may gamble on securing lower rates in a few months and opt for another tender round."

Xeneta added that entering negotiations with a clear understanding of market averages, highs, and lows across trade lanes and equipment types was crucial.

"This situation also explains the growing popularity of index-linked contracts, which eliminate the need for renegotiation when freight rates fluctuate."