As container spot rates continue to skyrocket, shippers are concerned that prices will increase to such an extent that many will not be able to afford to ship their goods.

“Shippers are clearly getting anxious about how high rates may go,” says Alan Murphy, CEO of maritime consultancy Sea-Intelligence. “But the truth is, nobody really knows. If prices increase sufficiently, and many shippers cannot afford to ship their goods, this will lower container demand, to the point where it matches the available vessel capacity.”

But at what point this will happen is unknown. “The easiest answer to ‘how high can rates go?’ would be to point to the maximum level seen during the pandemic,” says Murphy. This, however, does not account for the increased round-Africa sailing distances that weren’t present during the pandemic.

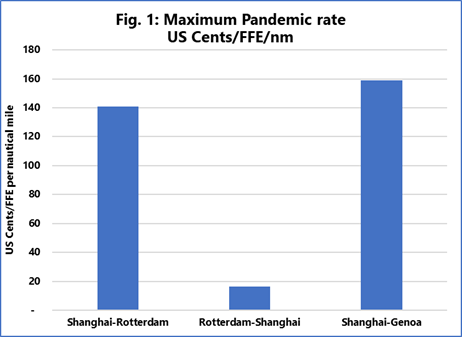

“To account for the longer sailing distances, we can look at the rates in relation to the distance sailed, ie US cents/FFE for each nautical mile sailed. For the pandemic, this is shown in Figure 1. While Figure 1 is simply a display of historical fact, it also sets a precedent, which is that during times of severe distress, freight rates per nautical mile can reach these very high levels.

“If we extrapolate the data from Figure 1 as an indication of how high the market can indeed go based on the pandemic surge in rates, we can now apply the new (longer) sailing distances and calculate how high the spot rates per FFE could possibly go, if the current crisis persists.”

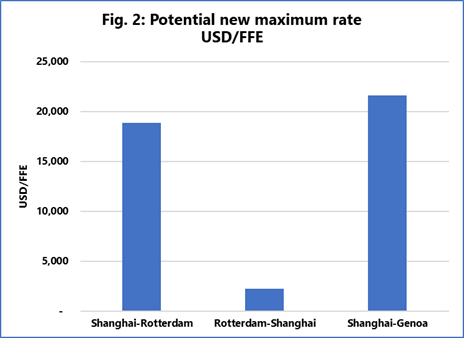

The result of this calculation is shown in Figure 2, which indicates the concerning scenario for shippers. “If the rate paid per nautical mile reaches the same level as during the pandemic, we will see spot rates of 18 900 USD/FFE from Shanghai to Rotterdam, 21 600 USD/FFE from Shanghai to Genoa, and 2 200 USD/FFE on the back-haul from Rotterdam to Shanghai. This is not to say that the rates couldn’t go any higher; this is just to say that if rates per nm go as high as during the pandemic, then spot rates would go as high as shown in Figure 2.”