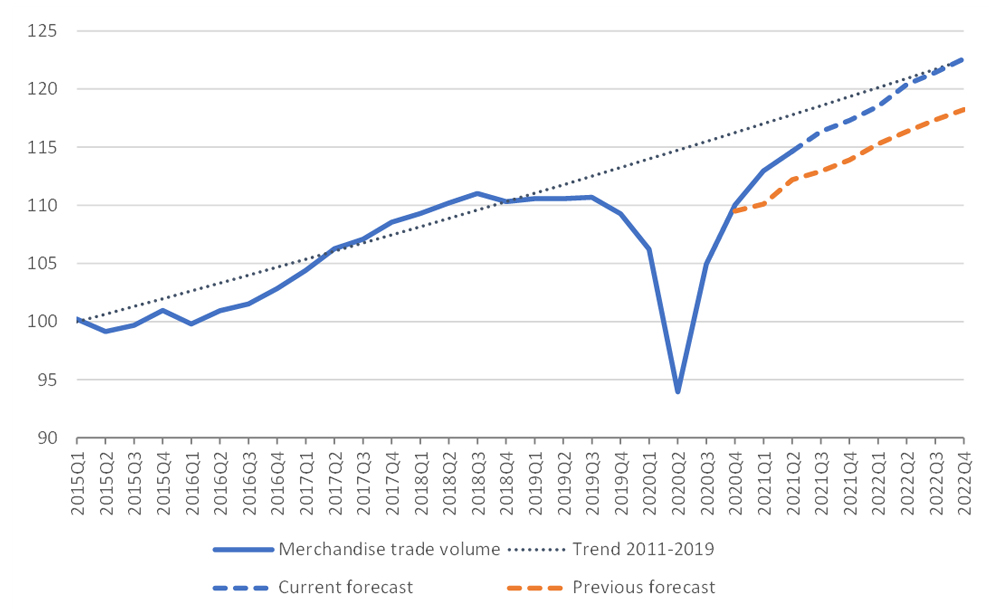

The resurgence of global economic activity in the first half of 2021 lifted merchandise trade above its pre-pandemic peak, leading WTO economists to upgrade their forecasts for trade in 2021 and 2022.

The WTO is now predicting global merchandise trade volume growth of 10.8% in 2021 - up from 8.0% forecast in March - followed by a 4.7% rise in 2022. Growth should moderate as merchandise trade approaches its pre-pandemic long-run trend. Supply-side issues such as semiconductor scarcity and port backlogs may strain supply chains and weigh on trade in particular areas, but they are unlikely to have large impacts on global aggregates. The biggest downside risks come from the pandemic itself, the WTO points out.

Behind the strong overall trade increase, however, there is significant divergence across countries, with some developing regions falling well short of the global average.

"Trade has been a critical tool in combatting the pandemic, and this strong growth underscores how important trade will be in underpinning the global economic recovery," Director-General Ngozi Okonjo-Iweala said. "But inequitable access to vaccines is exacerbating economic divergence across regions. The longer vaccine inequity is allowed to persist, the greater the chance that even more dangerous variants of Covid-19 will emerge, setting back the health and economic progress we have made to date.

"As we approach the 12th Ministerial Conference, members must come together and agree on a strong WTO response to the pandemic, which would provide a foundation for more rapid vaccine production and equitable distribution. This is necessary to sustain the global economic recovery. Vaccine policy is economic policy - and trade policy," she said.

The large annual growth rate for merchandise trade volume in 2021 is mostly a reflection of the previous year's slump, which bottomed out in the second quarter of 2020. Due to a lower base, year-on-year growth in the second quarter of 2021 was 22.0%, but the figure is projected to fall to 10.9% in the third quarter and 6.6% in the fourth quarter, in part because of the rapid recovery in trade in the last two quarters of 2020. Reaching the forecast for 2021 only requires quarter-on-quarter growth to average 0.8% per quarter in the second half of this year, equivalent to an annualised rate of 3.1%.

Chart 1: World merchandise trade volume, 2015Q1-2022Q4

Despite Covid-related interruptions, container throughput in international ports remains at or near record levels. Meanwhile, shipping rates have risen dramatically, exemplified by a more than four-fold rise in the Shanghai Containerized Freight Index over the past year. The spike in shipping rates coincided with a strong rebound in the new export orders component of the global manufacturing PMI, indicating surging global import demand. Prices of manufacturing inputs and final goods also rose, while stocks of finished goods dipped, and delivery times stretched out, the WTO adds.