Despite President Cyril Ramaphosa’s assurances that Transnet is on the mend, the irrefutable fact is that the state-owned enterprise has experienced an operational implosion, according to the economist of the North-West University’s (NWU) Faculty of Economic and Management Sciences, Professor Waldo Krugell.

The situation is costing the country dearly, despite there being an export upside to the situation which South Africa is missing thanks to Transnet’s parlous situation.

In a report for the faculty, he said the malfunctioning of Transnet’s various divisions and inability to provide adequate and regular rail transport, port management and pipelines had resulted in the weakening of the local currency which is having a devastating effect on the import and export of goods and services.

According to the global Big Mac Index, the rand should trade at around R11.50 to the dollar. More complex models say it should be around R15 to the dollar, Prof Krugell said. The Big Mac Index has been a widely used index since 1986. Introduced by The Economist, it is an informal way of measuring the purchasing power parity (PPP) between two currencies and providing a test of the extent to which market exchange rates result in goods costing the same amount in different countries.

“In rand terms, we are therefore paying more than we should for imports. This is particularly detrimental when you consider that most of our fuel is imported, as are many other industrial imports. But, fortunately, it also cuts the other way. Exporters are R3 per dollar more viable than they would be at the fair value rate,” he said.

That is the opportunity the country is wasting because of the logistics crisis caused by Transnet and its ports.

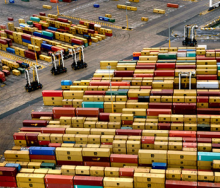

In January the situation at the Port of Cape Town’s container terminal had improved slightly for ships as their visits to it had been reduced to 7.5 days, but the target is only one day, he said.

“It is peak export season for the fruit industry and there is still a backlog of exports,” Prof Krugell said.

The Port of Durban handles 80% of South Africa’s container shipping and the problems there were reflected in December’s trade statistics.

Imports were down 5% month-on-month and exports plunged 11.5%.

“As a result, the International Monetary Fund (IMF) recently downgraded South Africa’s growth outlook to 1% for 2024.

“The worst part is that the export industries are pleading for a chance to help to address the problems of poor management, but the government is unwilling to just get out of the way,” Prof Krugell concluded.