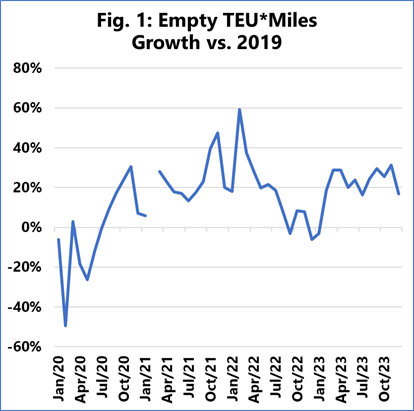

The ripple effect of growing global trade volatility is impacting the entire logistics chain – not least the movement of empty containers which has grown around 20% in the past few months compared to 2019 (avoiding the extreme volatility of the pandemic).

That’s according to a study undertaken by maritime consultancy Sea-Intelligence, which used data from Container Trade Statistics region-region movement of full containers. “This has enabled us to approximate empty container movements to see how growing trade imbalances have impacted the work needed in relation to empty container repositioning,” says CEO Alan Murphy.

While analysing volume simply in TEU terms can be a reasonable gauge of market behaviour, as the operational costs related to the empty movements are mainly linked to port handling costs, it can be argued that TEU miles are a better measure since they are the best measure for full containers, in Murphy’s view. “This is because the distance travelled is critical when evaluating container demand, and it might appear incongruent if we do not assess empties in the same way.”

Essentially, the development when measuring empty movements by TEU miles is no different from measuring in TEUs. The question is how this then matches up to the growth in full containers. “Global TEUs grew 2.5% compared to 2019, and 4.2% in TEU miles. On solely the headhaul trades, TEU growth was 7.8% in December 2023 compared to 2019, and TEU miles growth was 8.0%.

This makes it very clear, says Murphy, that the need to move empty containers has grown significantly more than the need to move full containers, with the backhaul trades growing two and a half times faster. “This means that the actual costs related to moving headhaul containers have grown, and de facto this means that headhaul shippers need to cover an increasing cost of moving empty containers going forward.”