As the demand/supply cycle begins to normalise, in line with expectation, the 2022-Q4 financial and volume data published by the shipping lines clearly indicate a market in decline.

This is according to research by maritime consultancy Sea-Intelligence.

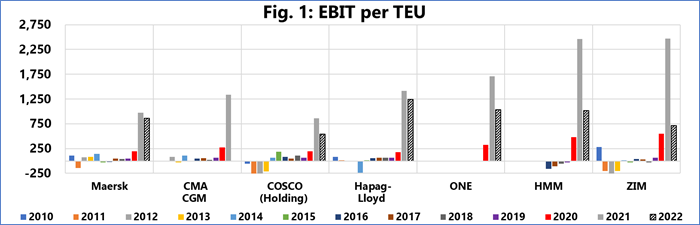

“Even though the shipping lines recorded a 2022-FY Ebit of $138 billion – minus CMA CGM (did not publish Ebit), PIL (have not published FY accounts), and MSC (privately held so does not publish accounts) – there were visible indications of a weakening market,” says CEO Alan Murphy.

“While all of the shipping lines have remained profitable in 2022-Q4, there was significant disparity between the larger and smaller shipping lines, with none of them able to grow their Ebit; five shipping lines recorded a year-on-year (y-o-y) Ebit decline of $1-2bn, and three carriers recorded a decline of over $2bn. In fact, y-o-y, the combined Ebit decline was a staggering -46%.”

Murphy points out that this is also quite evident when we look at Ebit/TEU. While the largest carriers managed to maintain Ebit/TEU levels close to those of 2021-Q4, the smaller lines were not able to repeat the windfalls seen a year earlier. On average, the carriers recorded Ebit/TEU of $843/TEU in 2022-Q4, down 33% from 2021-Q4’s $1 252/TEU, but still vastly above the $17.6/TEU on average in 2010-2019.

“To add to that, there has been a strong y-o-y volume decline on both Transpacific and Asia-Europe, whereas on a global level, apart from HMM, the remaining reporting carriers have all recorded varying degrees of volume contraction. In the case of HMM, they have disrupted the market to some extent with an 8% growth in volume y-o-y.”