Just as schedule reliability was beginning to normalise after the Covid-19 disruptions, the Red Sea crisis has thrown a spanner in the works.

An analysis of the 2023-FY figures by maritime consultants Sea-Intelligence reveals that annual global schedule reliability improved by 19.5 percentage points (PP) from 42.6% to 62.1% in 2023.

Despite the sharp improvement, it only reached the level of 2020 and is still below the 70%-80% of 2012-2019.

“What is concerning, however, is that schedule reliability has declined month-on-month for the entire Q4, and we are likely to see a similar impact for January 2024 due to the Red Sea Crisis,” says Sea-Intelligence CEO Alan Murphy.

But he believes that this should be temporary. “Once the additional transit time is accounted for in the carriers’ schedules, we will potentially see an improvement. Lastly, the crisis came too late to have any significant impact on average delay, which improved from 6.38 to 4.83 days in 2023-FY.”

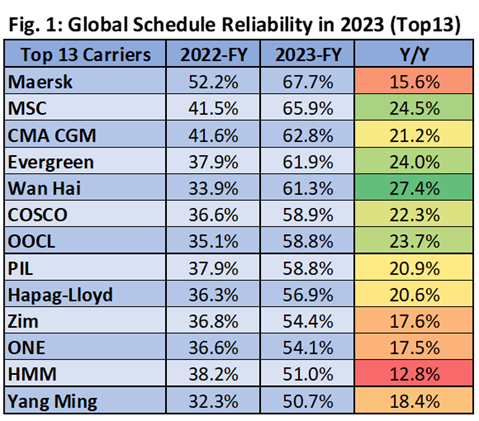

Maersk (67.7%), MSC (65.9%), CMA CGM (62.8%), Evergreen (61.9%), and Wan Hai (61.3%) were the only carriers above 60%.

All 13 global carriers recorded a double-digit year-on-year (y-o-y) improvement, with Wan Hai recording the largest improvement of 27.4 PP.

Of the alliances, 2M was the most reliable at 57.8%, followed by Ocean Alliance (55.3%) and THE Alliance (43.1%). While all of them recorded double-digit y-o-y improvements, only 2M scored better than the industry average on the six major East/West trades. Those six trade lanes also recorded y-o-y improvements in 2023-FY, however only the Asia-Mediterranean trade lane outscored the industry average on a trade lane level.