At a time of growing uncertainty about geopolitical realignment and deteriorating trade relations between Europe and the US, what with Donald Trump and Vladimir Putin involved in a bromance, the world is taking love a little more seriously – at least on one level.

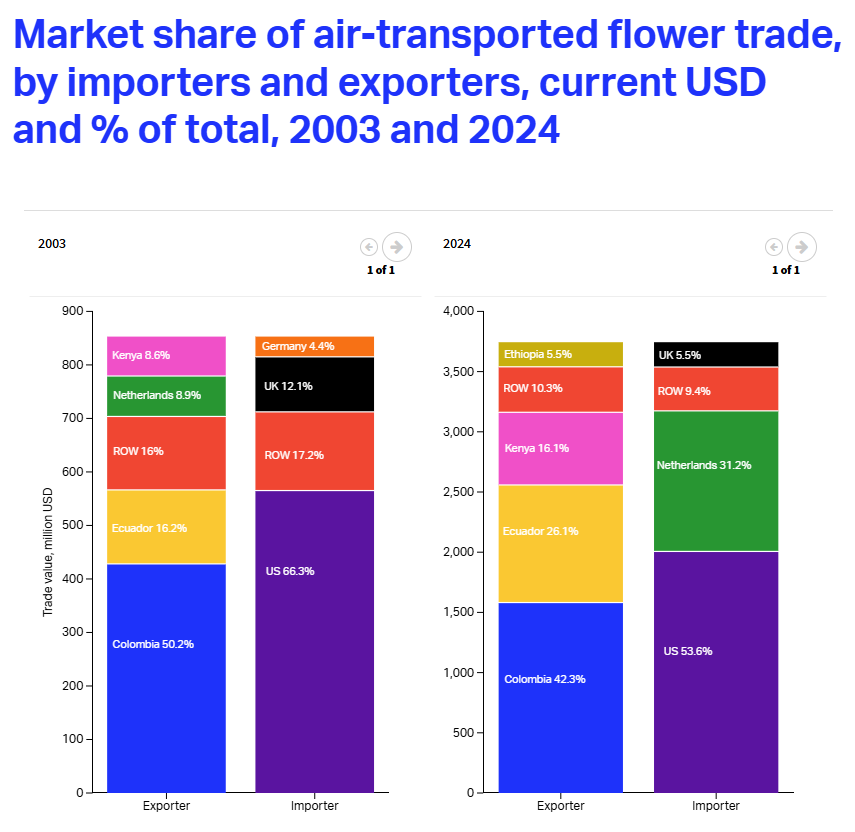

According to the latest figures from the International Air Transport Association (IATA), the value of trade in flowers transported by air has risen in a rather spectacular fashion from $852 million US dollars in 2003 to a staggering $3.7 billion in 2024.

This four-fold blossoming in freshly-cut flower trades, underscores market analysis of a noticeable shift and concentration among participants’ floricultural value chains.

Based on historical data, IATA found that imports had been dominated by the US, the UK and Germany in 2003, with respective shares of total imports of 66.3%, 12.1%, and 4.4%.

However, by 2024 the US imported 53.6% of the total, followed by the Netherlands at 31.2%, a main distribution hub for flower trans-shipment.

The UK, known across the world for the Chelsea Flower Show, seems to have somehow lost the plot, currently sitting at 5.5% of imports.

On the export scene there have also been noticeable market shifts.

In 2003, Colombia was the lead exporter with a 50.2% market share, followed by Ecuador at 16.2% and the Netherlands at 8.9%. Colombia has since pulled back to 42.3%.

The Netherlands has been knocked off the list in favour of expanded market shares by Ecuador and Kenya, as well as by newcomer, Ethiopia.

IATA has found that two key factors contributed to this shift.

First, trade agreements reduced tariffs and barriers, increasing exports and opening markets for developing nations. Second, developments in air cargo, including improved refrigeration and logistics, ensured that flowers remained fresh and enabled seamless global distribution of large volumes on time.

Air transportation has greatly facilitated the trade in all kinds of perishable goods, including flowers. These evolutions have prompted new specializations in the function of emerging comparative advantages, leading to greater market concentration.

As these factors embody little to be considered swoon-worthy, we leave our readers to ponder which countries might have a comparative advantage in romance.