The first quarter saw a continuation of the trend of notable improvement across all metrics of schedule reliability and average delay on a global, carrier, carrier alliance, and trade lane level.

That’s according to research by maritime consultancy Sea-Intelligence which says the metrics are now closer to the pre-pandemic levels than to the below-par service levels of the pandemic-impacted years.

On a global level, reliability increased to 58.3%, which was a 3.4 percentage point (PP) increase quarter on quarter, and a 24.9 PP improvement year on year (y-o-y). In similar vein, the average delay for all vessel arrivals improved to 1.70 days, dropping by -2.88 days y-o-y, while the average delay for late vessel arrivals improved to 5.23 days, a notable -2.43 day improvement y-o-y, says CEO Alan Murphy.

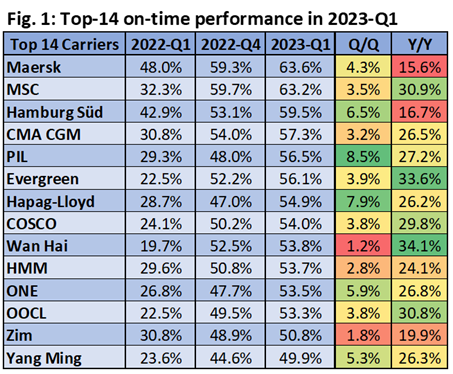

The top-14 shipping lines (shown in Figure 1) all recorded double-digit y-o-y improvements, with four of them recording improvements of over 30 PP. Maersk was the most reliable carrier in 2023-Q1 with schedule reliability of 63.6%, with MSC the only other carrier higher than 60%. Eleven of the 12 remaining shipping lines were within 50%-60%, with Yang Ming the only exception at 49.9%.

The three carrier alliances also recorded sharp y-o-y improvements, although only 2M and Ocean Alliance outperformed the industry on the East/West alliance trades, but that too by under 2 PP. THE Alliance, on the other hand, underperformed the industry by a significant -12.1 PP.

All of the six major East/West trades recorded double-digit y-o-y improvements, although all of them underperformed compared to the global industry average.