How loyal are shippers to their carriers?

Research undertaken by maritime consultancy Sea-Intelligence illustrates an asymmetry when it comes to loyalty.

It appears that carriers who raise their rates more slowly are not rewarded similarly when the market turns negative. From a carrier perspective, it is better to increase rates as fast as possible, rather than to hope for shipper loyalty when the market turns, says CEO Alan Murphy.

One of the key challenges in container shipping is the lack of shipper/carrier contract enforceability, he points out. “With freight rates increasing sharply, as they have been recently, there are calls for carriers to stick to contracts, and moderate their pursuit of revenue.

“Such calls would implicitly assume that shippers would reciprocate when the market eventually goes down. So, is it correct, that if a carrier is less aggressive in terms of rate increases when the market goes up, then the customers will also be more loyal when the market goes down?”

Apparently not.

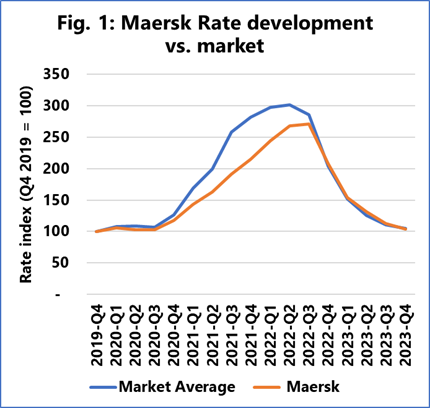

In Figure 1, the blue line shows the market average freight rate, based on the global rate index from Container Trade Statistics, while the orange line is Maersk’s average freight rate. Both are calculated on a quarterly index basis, with the average freight rate in 2019-Q4 set as index 100.

“We can see that Maersk raised their global average rate level significantly slower than the market during the pandemic. However, when the rate levels began declining, Maersk saw a decline fully matching the market decline, which means that in this case, there was no quid pro quo from the shippers.”

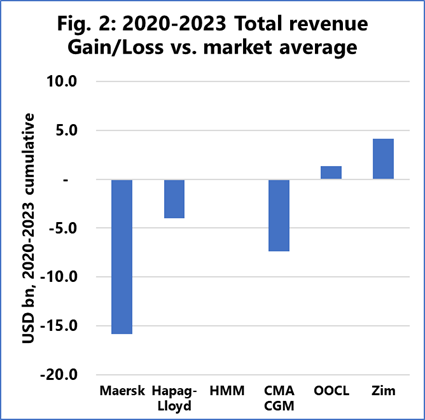

Figure 2 shows the loss/gain in US dollar revenue from not following the market, for those major carriers where it can be calculated. Maersk had a potential loss in revenue of $15.7 billion in 2020-2023. At the other end of the spectrum, ZIM gained revenue of $4.2bn by increasing rates faster and higher than the market.