The rates windfall in the ocean and airfreight sectors appears to be at an end.

While sea freight rates have peaked according to several maritime experts, including freight benchmarking platform Xeneta, the same appears to be true for the air cargo sector.

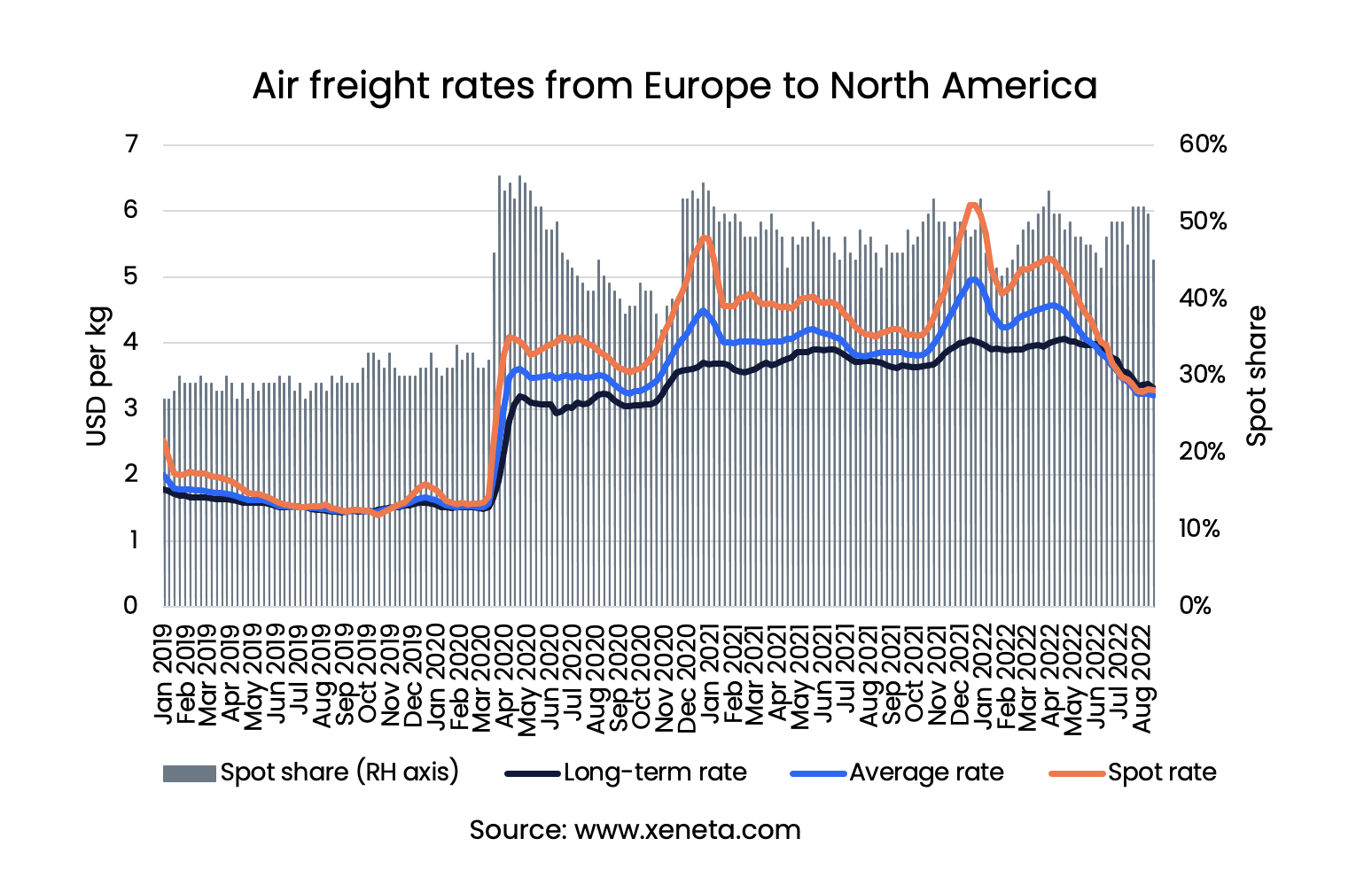

According to Xeneta, rates on the essential Transatlantic head-haul from Europe to North America have fallen by 32% since the start of the year, sitting at $3.2 per kg in the week ending August 21.

This is the lowest average freight rate that airlines have reported since April 2020, says Xeneta.

However, the current level for airfreight rates is still double the average freight rate in pre-pandemic 2019.

"Zooming into the difference between the spot and long-term markets, the decline in spot rates was the main driver behind the decrease in the average freight rates - with the spot rates falling by 42% since the start of the year. In comparison, long-term rates went down by a more modest 16%.

“The different magnitude of declines between the two rates on Europe to North America trades saw spot rates fall slightly below long-term rates by mid-June.

In mid-August, long-term rates were $0.1 per kg higher than on the spot market, while at the start of the year, spot rates were $1.7 per kg higher.”

This is the first time, says Xeneta, that long rates have fallen below the spot on this trade since the Covid pandemic. “The last time airlines earned more per kg shipped on the long-term market than on the spot market was in October 2019.”

Compared to pre-pandemic times, the higher spot market share is attributed to higher market uncertainty, such as global cargo capacity constraints and increased geopolitical tensions. “It makes the flexibility of spot market contracts more attractive to airlines.”

Shippers can also see the benefits of the spot market under the current circumstances. Xeneta expects shippers to remain reluctant to sign long-term contracts at such high rates while the outlook remains unclear.

Given that uncertainty is coming from everywhere, the view is that the spot market share for the rest of the year is unlikely to change considerably unless drastic changes to the current airfreight market occur.